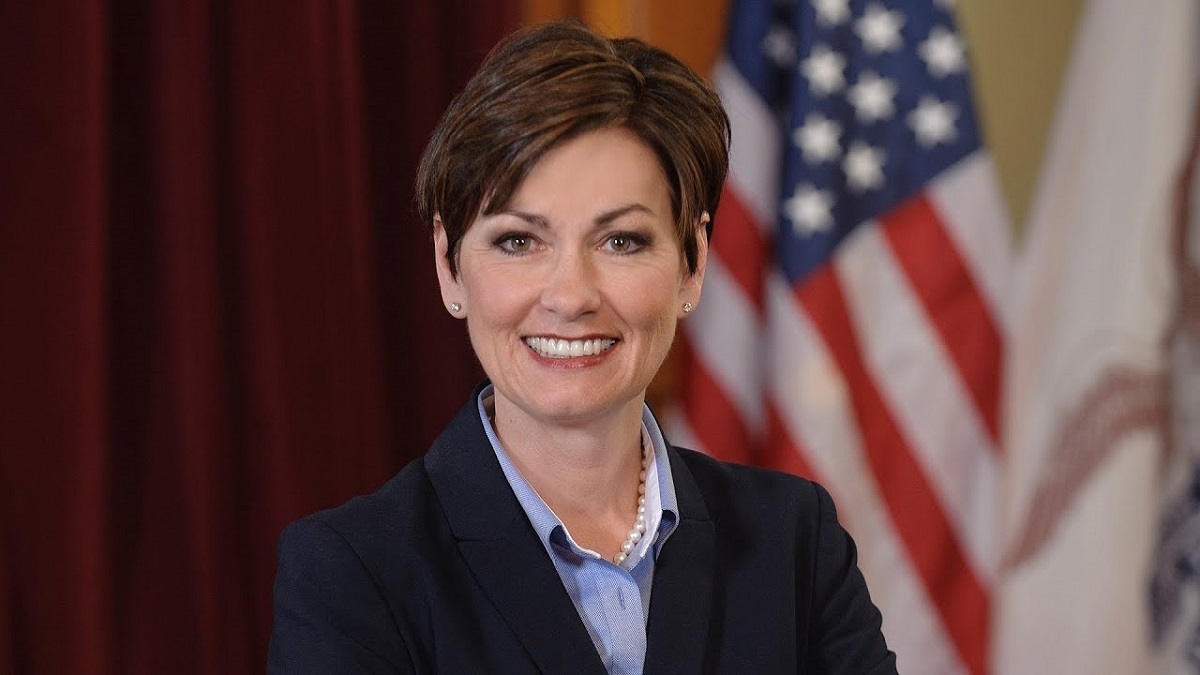

Gov. Kim Reynolds | Youtube

Gov. Kim Reynolds | Youtube

Iowa Gov. Kim Reynolds is working to accomplish a major tax break for certain people in Iowa who she feels have earned the break, amongst other tax reforms.

The proposed bill would exempt Iowans age 55 and older from paying income tax.

“You’ve worked hard all your life, saving for retirement and paying your fair share in taxes," Reynolds said during her Condition of the State address. "It’s time you get a break from the tax collector; you’ve earned it, now you should enjoy it."

The bill would also exempt farmers from paying income tax on cash rent payments. Another goal of the bill is to get rid of the top tax bracket each year until a 4% flat tax rate is accomplished in the tax year of 2026. The plan would constitute a major tax cut across the whole state, taking Iowa from the state with the sixth highest total income tax to the state with the fifth lowest.

The plan would also make Iowa one of the most tax friendly states in the United States, potentially attracting new businesses and residents. Reynolds is also planning reforms in Iowa's corporate tax system. The state of Iowa is in a strong position fiscally with almost $1 billion in cash reserves.

Another tax reform planned by Reynolds is the exemption of net capital gains on the sale of employee-awarded capital stock.

These plans were laid out by Reynolds at her 2022 Condition of the State address, which was held on the evening of Jan. 11. Reynolds took the opportunity in the Condition of the State address to praise the state as a whole, stating that Iowa was ranked No. 1 in economic opportunity by the U.S. News and World Report.

Alerts Sign-up

Alerts Sign-up